#4 Fall 2022 Project Wrap-Up

👋🏾 Welcome to Illini Blockchain Updates - the newsletter that gives you a sneak peek into one of the fastest-growing blockchain orgs in the nation.

✨ If you’re a new reader, thanks for stopping by. Feel free to check out this intro post, which explains what Illini Blockchain Updates is all about.

Purpose

Illini Blockchain Updates is a way for us to connect with our general community and partners to show you what cool stuff we have been up to. If any of our projects sound interesting or you’d just like to get involved shoot us a dm on twitter @ILL_Blockchain or email us at illiniblockchain@gmail.com.

Note

Illini Blockchain has 2 types of members: researchers and developers. Those members are split into sub-teams that each are working on one or more cool, unique projects. In Spring 2023, we have a bunch of new projects that we are working on both the developer and the research side.

Developer Projects S23

Decentralized Microlending Platform

Securities Team

Researcher Projects S23

Investment Board

Data Sciences Team

Deep Dives Team

Updates

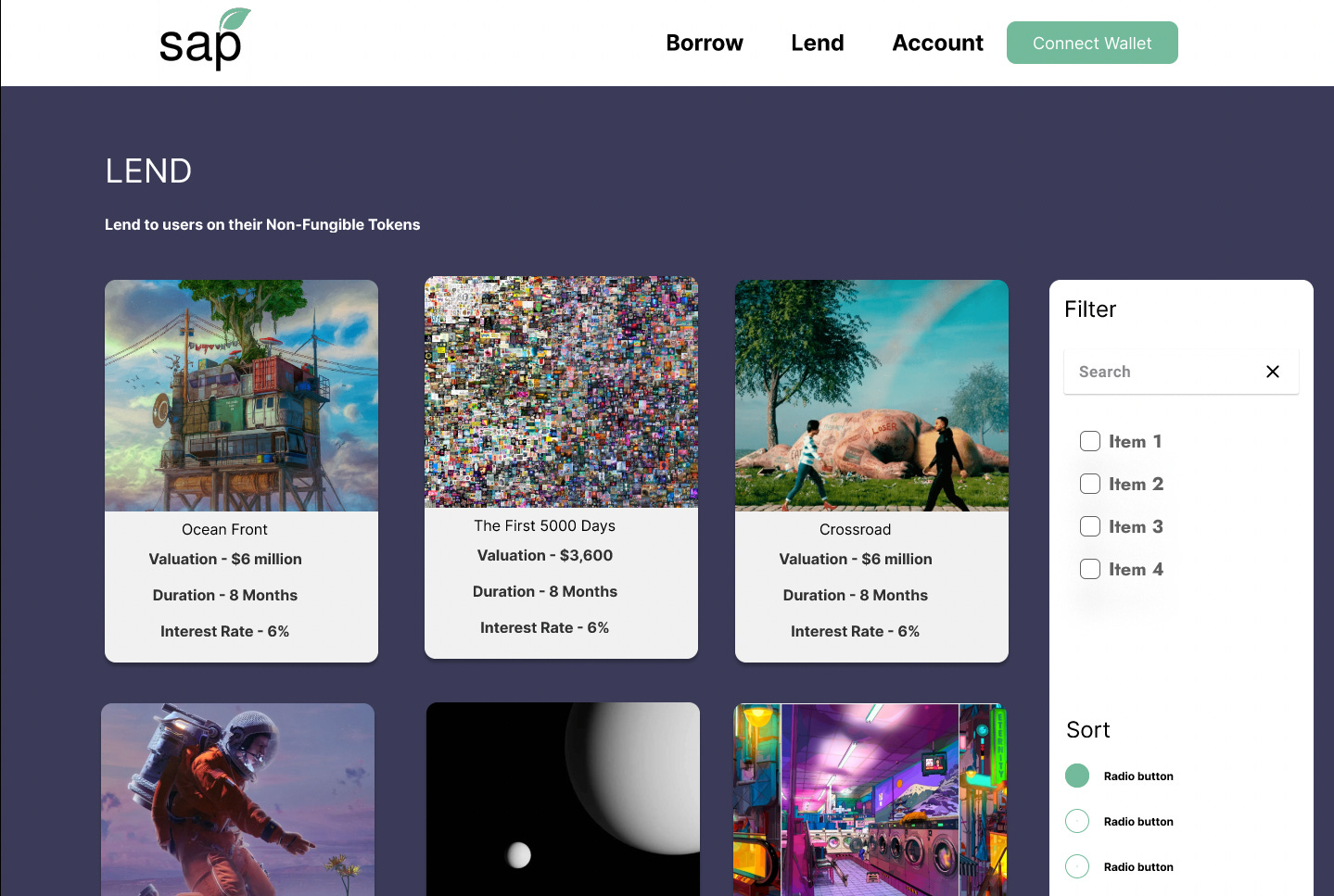

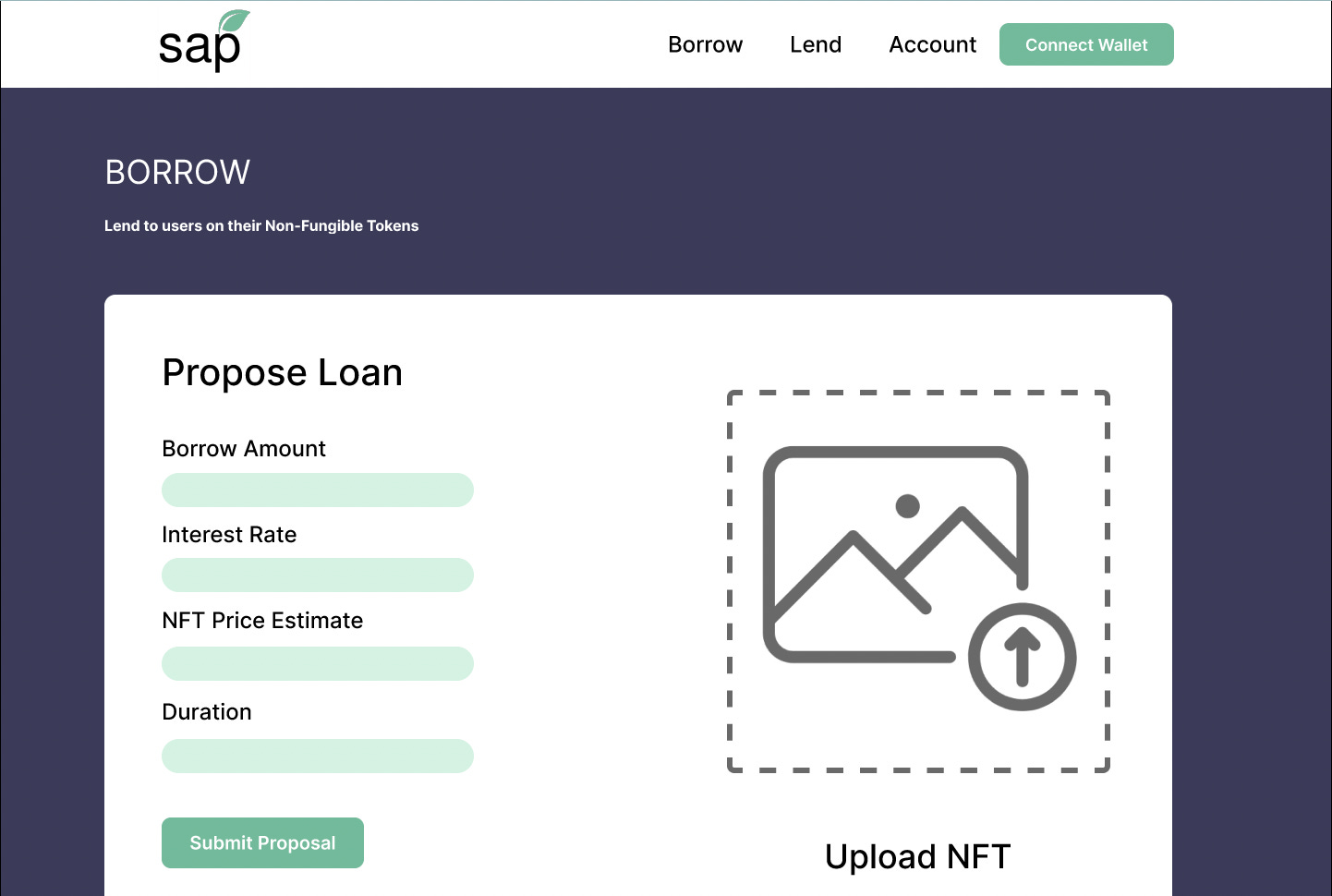

Devs #1: Sap Team

Context: In the last few months, NFTs have found their way into DeFi, as holders seek for utilities beyond just the images. One of the new use cases for NFTs in DeFi is the collateralization to take out loans. While the collateralization protocols remained sound in a bull market, a number of flaws have emerged in a bear market that leaves room to explore new ideas and frameworks.

What they do: This semester the SAP team worked on building an NFT collateralized lending platform. Lending platforms typically accept ERC-20 tokens as a form of collateral, and our team thought it would be interesting to explore the use of ERC-721 tokens for collateral. The team considered why other platforms in the space had failed and made a variety of design decisions to create a safer platform for lenders. The team came to the conclusion that NFT prices move on a case-by-case basis, and thus can not be treated like typical collateral. So, the SAP Lending platform is based on a bidding system where borrowers can list their ideal loan terms (parameters include: loan duration, loan amount, collateral valuation, collateral ratio, interest rate) and lenders can choose to fill those loans or make a counter offer. In the end, the team finished 90% off the smart contract work (https://github.com/IlliniBlockchain/sap) and started to design a front end (see front end photos at the bottom)

Challenges: 1) Accurately pricing NFTs constantly without the expensive use of Chainlink’s Oracle is more difficult than it may seem. The team ended up writing its own oracle. This is a temporary solution and relatively centralized. 2) Liquidating undercollateralized loans is hard. We could write a bot to do it ourselves, incentivize third parties, or just transfer the NFT collateral to the lender and leave it up to them. The former two felt unrealistic for a semester project, and the third option was a problem because we couldn’t guarantee that the lender would act honestly.

Next Steps: Looking to the future we need to continue building our front end, work more on liquidations, and conduct rigorous testing.

Devs #2: Agora Team

Context: A decentralized marketplace would enable sellers to capture a greater sale price as profit and allow users to sell their items without the heavy rules of a centralized platform. Such a platform offers a competitive alternative to centralized marketplaces for buyers, due to lowered prices from decreased seller fees. It also expands the convenience of online shopping to the unbanked and more. Also, a project of this scope would help bridge a gap between crypto payments and real life assets, an area which still has a lot of room for improvement.

What They Do: This semester we created Agora Marketplace, a decentralized peer-to-peer buying and selling platform that allows anyone from anywhere across the globe to use their crypto as a way to buy the products they need in their everyday life. In order to settle disputes on our platform, we also created a joint product, Agora Court, which is a decentralized arbitration protocol that any dApp can interface with to resolve conflicts on their own platforms. We mainly focused on writing the Solana smart contracts using the Anchorlang library, completing a majority of the backend infrastructure last semester.

Challenges: Creating a dispute system that was both easily customizable but not overly complex to interface with was a big problem. We had to thoroughly think through exact what functionality we wanted to manage versus leaving up to the control of the protocols. An example of this is using tokens designated by interfacing protocols to use as a reputation score. We do not inherently control these tokens so it is difficult to mint new tokens as rewards or other things that we would like to do without tampering with the tokenomics of the external coin.

Next Steps: With Solana Riptide, the biggest Solana hackathon, approaching next month, we need to test our code and create some demo apps to showcase our work. From there, we would like to start marketing ourselves to gain a userbase and start getting people to use Agora on Solana.

Devs #3: Bitcoin Full Node

Context: There are different types of nodes (aka computers) that run on the Bitcoin network. One type is a full node which stores the entire blockchain history.

What They Do: This semester we set up a bitcoin full node and Neo4j server, both on AWS as we just needed some computing resources to get started quickly. We wrote an ETL (Extract, Transform, Load) process in Go (https://github.com/IlliniBlockchain/etl-bitcoin) to get blockchain data from the node and index it in Neo4j to allow us to do some interesting graph-based queries and visualizations on the data. We ended up getting the whole process working and now have a Neo4j dashboard we can play around with internally.

Challenges: Most of the challenges we faced were from just being new to the tech stack. Some of the team was new to Go and none of the team had worked a ton with AWS or Bitcoin Core in a development context before.

Next Steps: In the future, we would like to open up access to this Neo4j dashboard to students on campus, get a full node on campus infrastructure somewhere, and do a similar ETL process with an Ethereum node as there's much more data to work with.

Researcher #1: Startup Team

What They Do: Reaching out and working with different start-ups to do deep dive breakdowns, beta test products, & consult on projects. This semester the startup team worked with 4 main partners: Dropverse, 1Wallet, Underdog Protocol, and Spawn. With these startups, we helped beta test, helped plan a future hackathon and other community events, created a twitter thread with 1200 impressions, and laid the groundwork for building a platform to connect us and other partners to industry leaders.

Challenges: Limitations to what we can do with a non-technical team. Speed of production was low compared to what we were hoping for which lead to lots of waiting.

Takeaways: Partners are the most valuable thing in the Blockchain space, and we have fostered relationships that we hope will allow both us and them to grow together.

Researcher #2: Beginner Research Team

What They Do: We partnered with 101.xyz to create a beginner-level web3 course covering the Ethereum Platform. Illini Blockchain was the first and only blockchain org to publish an educational course on 101.xyz. In under 48 hours, we had 500+ completions for our first 101.xyz and as of 1/29 have ~ 5000 completions. We’re pretty excited about it so if you’d like to check it out click here.

Challenges: Coming up with a concrete plan / vision with actionable steps. Moving away from basic “crypto education”. Tackling niche topics like ZK proofs.

Takeaways: It is super important for us to be producing original content that adds value. This allows us to get our name out there while doing our part in educating the masses. Lastly, this content does not need to be huge, sometimes less is more.

Researcher #3: Advanced Research Team

What They Do: This semester, the advanced research team worked on an industry deep dive that explored the different applications of decentralized finance (DeFi) in third-world economies. The article considered comparisons of applications in continents such as North America and Europe vs. third-world countries such as Venezuela and Lebanon. We also explored certain hurdles to crypto adoption worldwide, such as the hurdle of negative environmental impact and certain regulatory setbacks. The deep dive is meant to be an interesting insight for people who are new to understanding blockchain technology and its impacts. You can read it for yourself here: Crypto Usage Case Studies.

Challenges: The biggest challenge we faced was gathering data on different countries. Our initial plan was to use Python and R to analyze different countries and on-chain data, but we couldn't find any centralized databases to gather from. Another challenge was making sure the article was easy enough for people who don't have as much knowledge in blockchain and web3 to understand.

Takeaways: The biggest takeaway from working on this deep dive was that blockchain and DeFi are having positive impacts all around the world. At Illini Blockchain, it is our job to bring to light how blockchain can truly change our community. Although many might be skeptical of cryptocurrency within the US, it is helping many countries vulnerable to economic crises in combating inflation. Cases like these truly embody the true power of what such an emerging technology can provide for our society.

Community Events Team

Context: We have many students who want to get involved with Illini Blockchain (141 applicants and ~550 on the email list), but there is no clear path for them to get involved.

What They Do: Our goal would be to provide a path forward for community members to become more active.

Create a bank of research topics to dive into and get published by us

Host events with industry partners & other RSOs

Merch giveaways

External Events: This semester we hosted a bunch of events and saw a great turnout (~250 total attendees across all our events). We have lots of cool things planned for this semester so stay tuned for future community events!

Internal Team: This semester we also worked on fleshing out our internal events too. We implemented coffee chats, stand-up meetings, and other socials like a potluck and a trip to Chicago. We sent members to ETHSanFrancisco and Solana Breakpoint in Lisbon, Portugal. Looking to the future, we hope to be able to send many of our members out to events so be on the lookout for us at ETHDenver and at UPenn’s Blockchain Summit!

Wrap-Up

Thats it! Thanks for reading our 4th edition of Illini Blockchain Updates for the year, written by Samir Sheikh, Kevin Stumbris, and Luke Clancy. While this might be the last newsletter regarding our last semester projects, we’re really excited to show you what we have in store for 2023!

If any of our projects sounded interesting or you’d just like to get involved shoot us a dm on twitter @ILL_Blockchain or email us at illiniblockchain@gmail.com.

Team Pictures

Sap Front End

Lend Page

Making a Bid

Borrowing

Account